About Private Equity List

Private Equity List is a specialized, AI-powered database designed to streamline the discovery and connection process with private equity firms, venture capital funds, and other investment entities. It serves as a targeted, cost-effective alternative to larger, more expensive platforms like Pitchbook and Crunchbase. The platform's core mission is to provide users with super-intuitive search tools, a friendly user experience, and powerful, PE/VC-specific filters to find investor data effortlessly. It caters to a diverse user base of over 10,300 professionals, including startup founders, consultants, VC ecosystem players, universities, and business owners who rely on its data for fundraising, partnership development, and research. The recent major update introducing an AI search function underscores its commitment to leveraging cutting-edge technology for better user outcomes. Its primary value proposition lies in delivering human-curated, frequently updated investor lists with direct contact information in an export-ready format, all at a significantly more accessible price point than enterprise competitors.

Features of Private Equity List

AI-Powered Search

This intelligent chat-based search function allows users to find investors using natural language queries. Instead of relying solely on manual filters, you can describe your ideal investor profile (e.g., "Series A climate tech investors in the EU") and receive tailored results. The system is specifically trained for PE/VC searches, providing more relevant outcomes than generalist AI models, though users are advised to verify details for accuracy.

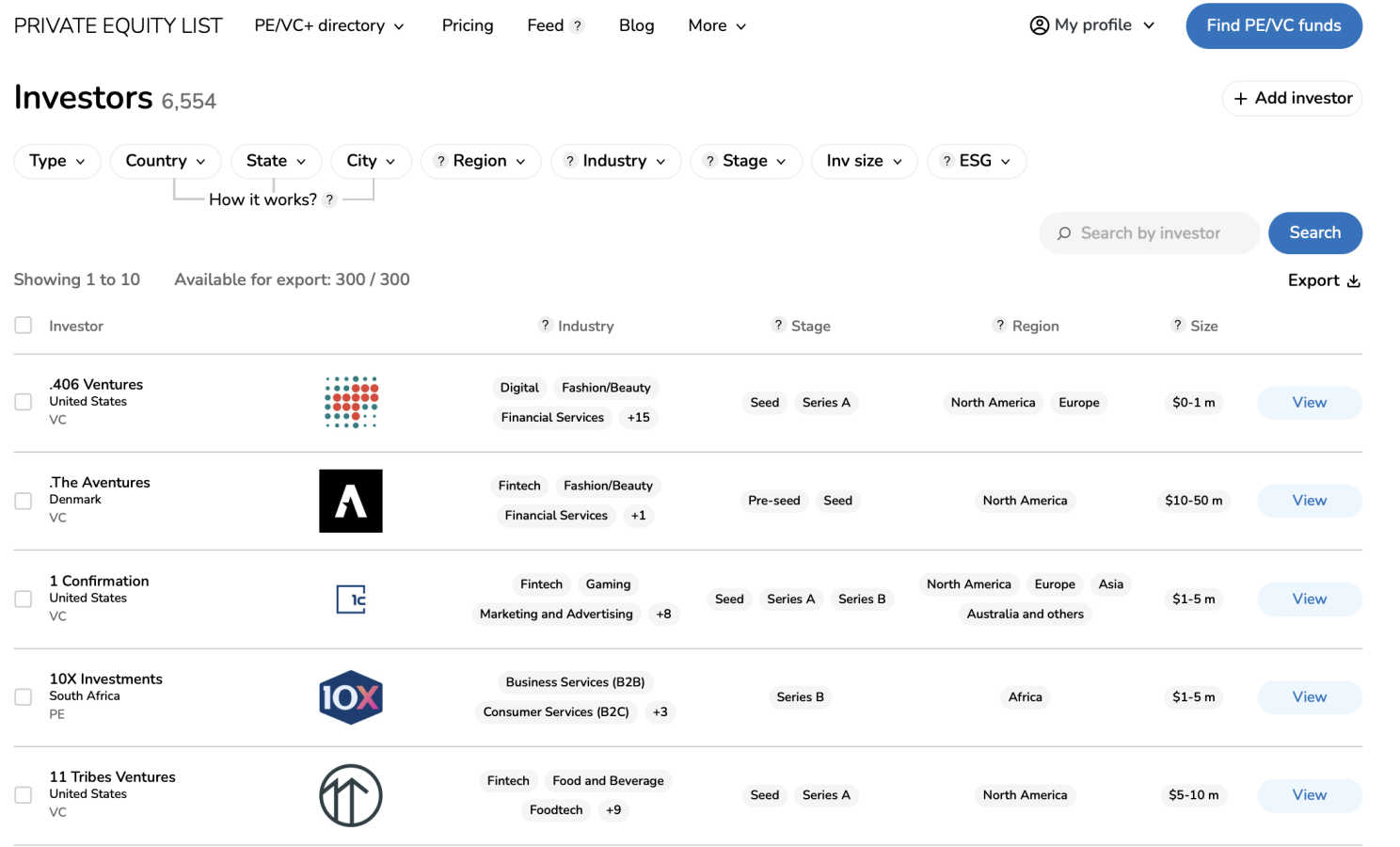

Super Intuitive Search & Filtering

The platform offers a lightweight, user-friendly interface with powerful, targeted filters designed specifically for private equity and venture capital. Users can quickly narrow down global investors by geography, investment stage, thesis, ticket size, and status (active funds only). This structured approach enables the creation of a usable, targeted investor shortlist in just a few minutes, bypassing the steep learning curve of more complex databases.

Comprehensive Investor Profiles & Contacts

Private Equity List provides detailed profiles on over 7,000 PE/VC investors globally, enriched with data on investment teams. It includes direct contact information for key roles, with over 27,000 contacts available. This feature is crucial for outreach, as it provides export-ready data (like .csv files) with contact enrichment at a much more affordable cost than other platforms that lock this functionality behind expensive enterprise paywalls.

Fresh & Curated Database

The database is updated nearly daily and focuses on providing actionable, human-curated data. A dedicated "New PE/VC" section highlights funds launched within the last 6-12 months that are actively seeking investment opportunities. This ensures users have access to the most current and eager investors, which is particularly valuable for early-stage founders looking for new sources of capital.

Use Cases of Private Equity List

Startup Fundraising

Founders from pre-seed to Series C can rapidly identify and connect with suitable investors. By filtering by geography, check size, and investment thesis, startups can build a targeted outreach list in seconds, significantly accelerating the capital-raising process and connecting with funds that are a strategic fit for their stage and industry.

Consultant & Advisor Deal Sourcing

Consultants and financial advisors use the platform to create precise, tailored shortlists of potential investors or buyers for their clients' fundraising or M&A mandates. The ability to quickly generate and export structured lists with contact details helps close client deals faster and secure success fees more efficiently.

VC Ecosystem Partnership Development

Existing venture capital funds, accelerators, and venture studios leverage the database to find co-investors and strategic partners across the global landscape of 6,000+ funds. This facilitates syndication deals and helps portfolio companies secure follow-on funding from complementary investors.

Academic & Market Research

Universities, journalists, government agencies, and independent researchers utilize the platform's intelligence for in-depth market analysis, reporting, and studies. The structured data on fund activities, geographic trends, and investment theses provides a reliable foundation for publishing reports and understanding PE/VC market dynamics.

Frequently Asked Questions

What makes Private Equity List different from Pitchbook or Crunchbase?

Private Equity List positions itself as a best-value, specialized alternative. It focuses exclusively on PE/VC data with a lightweight, intuitive interface and PE/VC-first filters, whereas larger platforms are more generalist and complex with analytics overload that leads to higher pricing. PEL emphasizes affordable, export-ready contact data and quick list generation without requiring a demo or enterprise sales process.

Is there a free trial or free plan available?

Yes, basic functions are available for free with no credit card required. This allows users to try the AI search and core platform features. The "Try for free" call-to-action indicates an accessible entry point for users to evaluate the database's utility before committing to a paid plan.

How accurate and current is the data on the platform?

The database is updated nearly daily and is described as human-curated. The platform shows a "Last database update" date and provides statistics on new funds and contacts added. While the AI search is powerful, the platform transparently notes that "PEL AI can make mistakes" and advises users to check for accuracy, indicating a commitment to data integrity.

Who are the typical users of Private Equity List?

The platform is used by a wide range of professionals, including employees from leading world companies and niche players. Specifically, it serves startups, consultants, advisors, VC ecosystem participants (funds, accelerators), and institutions like universities and government bodies for purposes like fundraising, deal sourcing, partnership building, and research.

You may also like:

Beeslee AI Receptionist

Beeslee is your AI receptionist that answers calls and books appointments 24/7.

Golden Digital's Free D2C Marketing Tools

Free AI tools for D2C brands to audit stores, calculate ROAS, and plan growth.

Fere AI

Fere AI deploys autonomous trading agents to research and execute crypto trades for you 24/7.