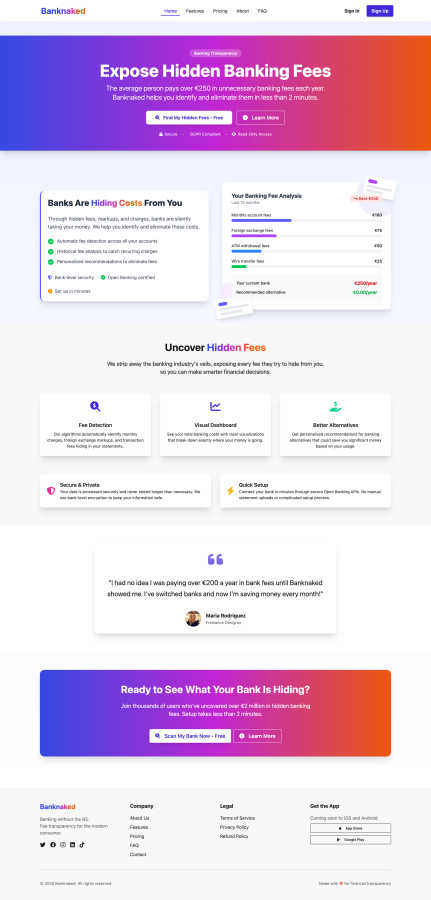

About Banknaked

Banknaked is a financial transparency tool designed to expose the true, often hidden, cost of everyday banking. It operates on a simple yet powerful premise: banks frequently levy a complex array of charges that are difficult for the average customer to track and understand. By leveraging secure Open Banking connections, Banknaked provides users with a clean, comprehensive breakdown of all fees associated with their accounts. This includes monthly maintenance charges, transaction fees, foreign exchange markups, ATM withdrawal costs, and vague miscellaneous charges. The platform is built with a staunch privacy-first philosophy, offering read-only access to accounts, encrypted data processing, and the ability for users to delete their data at any time. In minutes, users receive a total fee analysis, explanations in plain language, and an annualized projection of their banking costs. Furthermore, Banknaked provides personalized recommendations for cheaper account alternatives based on the user's actual financial behavior. It is designed for any consumer who uses a bank account and wants to stop overpaying, whether their goal is to switch providers, negotiate with their current bank, or simply understand where their money is going. The core value proposition is empowerment through clarity, helping users reclaim an average of over €250 per year in unnecessary fees.

Features of Banknaked

Automated Fee Detection

Our advanced algorithms automatically scan your connected bank accounts to identify and categorize every charge. This includes recurring monthly account fees, foreign exchange markups on international transactions, ATM withdrawal fees, wire transfer costs, and any ambiguous "miscellaneous" charges that banks often apply. The system performs a historical analysis to catch recurring fees you may have missed, ensuring a complete picture of your banking expenses without requiring manual statement review.

Visual Fee Dashboard

Banknaked presents your financial data through an intuitive, visual dashboard that transforms complex statement lines into clear insights. You can see your total banking costs over customizable periods, such as the last 12 months, with a clean breakdown presented in charts and graphs. This visualization makes it immediately obvious where your money is going, highlighting your most expensive fee categories and tracking your potential savings over time.

Personalized Bank Recommendations

Based on your actual transaction history and fee profile, Banknaked provides tailored suggestions for alternative bank accounts or financial products that could save you money. The system compares your usage patterns against market offerings to recommend accounts with lower fees, better terms, or features that align with your financial behavior, empowering you to make an informed decision to switch or negotiate.

Secure Open Banking Integration

Your security and privacy are paramount. Banknaked uses regulated, secure Open Banking APIs to connect to your bank, ensuring a read-only connection that never allows for money movement. All data is processed with bank-level encryption, and we adhere strictly to GDPR principles. You remain in full control, with the ability to revoke access and delete your data from our systems at any time.

Use Cases of Banknaked

For Proactive Budget Optimizers

Individuals focused on meticulous budgeting and maximizing their savings use Banknaked to identify a frequently overlooked expense category: banking fees. By uncovering hundreds of euros in annual charges, they can accurately adjust their budget, switch to a cheaper account, and reallocate those funds toward savings goals, investments, or debt repayment, achieving a more optimized financial plan.

For International Students and Frequent Travelers

People who regularly make cross-border transactions or withdraw cash abroad are often hit hard by foreign exchange markups and international ATM fees. Banknaked helps them quantify these exact costs, which are often buried in statements. With this clarity, they can seek out and switch to banks or fintech products specifically designed for international use, potentially saving significant amounts each year.

For Financial Negotiation and Review

Customers preparing to negotiate with their current bank for better rates or considering a review of their financial products use Banknaked to gather concrete evidence. The detailed fee report serves as powerful ammunition to challenge unnecessary charges or to leverage a better offer from a competitor, turning vague dissatisfaction into a data-driven discussion.

For General Financial Awareness

Consumers who simply want a clearer understanding of their financial footprint use Banknaked for demystification. It answers the common question, "What am I really paying my bank?" without requiring financial expertise. This awareness is the first step toward more conscious financial decisions and prevents passive acceptance of rising or hidden fees.

Frequently Asked Questions

Is Banknaked safe to use?

Yes, Banknaked is built with security and privacy as foundational principles. We use secure, regulated Open Banking APIs for a read-only connection to your bank, meaning we can never move your money. Your data is encrypted using bank-level security standards, processed transiently, and never sold. We are GDPR compliant, and you can delete your data from our systems at any time.

How much does Banknaked cost?

You can start using Banknaked's core fee analysis service for free. This includes connecting your bank, receiving a full breakdown of your fees, and getting your annualized cost projection. We offer a premium upgrade for users who want to go deeper with advanced insights, historical trend analysis, and more personalized recommendation engines.

Which banks are supported?

Banknaked supports all major banks and financial institutions that participate in the Open Banking framework. This covers a vast majority of consumer banks in the UK and European Economic Area. During the sign-up process, you can search for and select your bank to initiate the secure connection.

What do I do with the fee report from Banknaked?

The report provides you with actionable intelligence. You can use it to: 1) Switch to one of the recommended alternative bank accounts that better suit your usage patterns and cost less. 2) Contact your current bank to question or negotiate the fees you are being charged. 3) Simply become aware of your costs and adjust your financial behavior, such as using in-network ATMs to avoid charges.

You may also like:

Beeslee AI Receptionist

Beeslee is your AI receptionist that answers calls and books appointments 24/7.

Golden Digital's Free D2C Marketing Tools

Free AI tools for D2C brands to audit stores, calculate ROAS, and plan growth.

Fere AI

Fere AI deploys autonomous trading agents to research and execute crypto trades for you 24/7.