aVenture

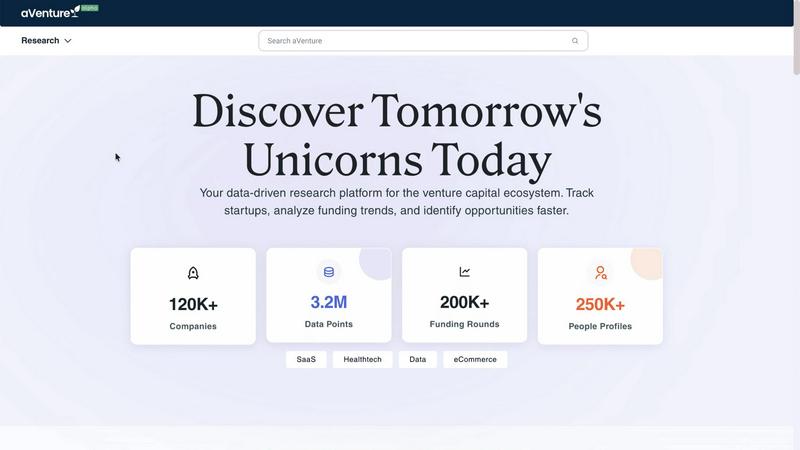

aVenture is an AI platform for comprehensive startup research and venture capital intelligence.

Visit

About aVenture

aVenture is an institutional-grade venture intelligence platform designed for comprehensive research on private companies and venture capital investing. It provides deep, actionable insights by tracking over 109,000 active venture-backed companies across 132 countries, aggregating data from more than 1,200 sources. The platform's core value proposition is transforming vast amounts of raw data into strategic intelligence. Its proprietary AI analyst continuously scans the latest news and coverage to deliver concise summaries of company traction, highlight potential risks, and explain how new events may impact a business. This empowers professionals to move beyond simple data lookup and into strategic analysis. aVenture is built for a wide range of users including founders preparing for fundraising, investment analysts conducting due diligence or building market maps, business development teams scouting for partners or customers, and operators monitoring their competitive landscape. With tools for investor mapping, signal tracking, and collaborative workspaces, aVenture serves as a central command center for making informed, data-driven decisions in the dynamic private markets.

Features of aVenture

Deep Company Insights

This feature provides a comprehensive profile for each of the 100,000+ companies tracked, going beyond basic facts. Users can access detailed ownership structures, complete funding histories with round sizes and valuations, and in-depth competitive positioning. The platform surfaces critical insights such as a company's market, stage, fundraising status, key competitors, and investor lists, delivering the depth of information institutional investors rely on for thorough analysis and decision-making.

AI-Powered Analyst & Signal Tracking

aVenture's AI analyst automates the monitoring of news and market signals for followed companies, funds, or themes. It intelligently filters out noise to deliver concise, actionable updates that highlight material changes, such as new product launches, key hires, or funding rumors. This feature summarizes traction, flags potential risks, and explains the context of new events, saving users countless hours of manual news scanning and ensuring they never miss a critical development.

Advanced Investor Mapping

This tool allows users to deconstruct an investor's portfolio with precision. You can see every company a specific venture capital firm or angel investor has backed and then apply powerful filters by sector, investment stage, and geography. This enables the rapid construction of highly targeted outreach lists for fundraising, partnership development, or competitive analysis, providing a clear view of an investor's focus and thesis.

Collaborative Workspace Tools

aVenture facilitates team-based research with robust organizational features. Users can save dynamic lists of companies or investors, annotate individual profiles with private notes, export filtered data sets for external reporting, and securely share research folders with colleagues. This turns individual analysis into a collaborative, scalable process, ensuring alignment across investment committees, BD teams, or founder groups.

Use Cases of aVenture

Due Diligence for Investment

Investment analysts and venture capitalists use aVenture to conduct thorough due diligence on potential deals. They can quickly assess a target company's complete funding history, cap table, competitive landscape, and recent news signals summarized by the AI. This helps in validating growth metrics, identifying potential red flags, and benchmarking the company against its peers to make a confident investment decision.

Competitive Market Mapping

Operators and strategists utilize the platform to map their competitive landscape. By searching for look-alike companies and analyzing nearby markets, they can refine their own positioning, identify emerging threats, and uncover new market opportunities. The ability to track competitors' hiring trends, funding events, and news coverage provides a real-time strategic advantage.

Targeted Fundraising Outreach

Founders preparing for a fundraise leverage the investor mapping tools to build a targeted list of potential backers. They can identify investors who have a proven history of investing in their specific sector, stage, and geography, dramatically increasing the relevance and efficiency of their outreach. Researching an investor's full portfolio also helps tailor compelling pitch narratives.

Partnership & Business Development Scouting

Business development and sales teams use aVenture to scout for potential partners, customers, or acquisition targets. They can filter companies by technology, business model, and growth signals to create lists of ideal prospects. Tracking news on these companies helps BD teams identify the right moment to engage, such as after a new funding round or product launch.

Frequently Asked Questions

What types of companies are tracked on aVenture?

aVenture tracks over 109,000 active, venture-backed private companies globally. This includes startups from seed to late-stage growth, across all major sectors like SaaS, Fintech, Biotech, Cleantech, and AI. The platform focuses on companies that have institutional investment, providing comprehensive data on their funding, investors, and performance metrics.

How does the AI Analyst work?

The AI Analyst is an automated system that continuously reads the latest news articles, press releases, and regulatory filings from a wide array of sources. It uses natural language processing to identify material information related to tracked companies, distilling lengthy articles into concise summaries. It specifically highlights traction metrics, potential risks, and the strategic implications of new events, delivering signal instead of noise.

Can I export data from aVenture for my own reports?

Yes, aVenture includes robust export functionality within its workspace tools. Users can export data from company lists, investor maps, and search results into common formats like CSV or Excel. This allows for easy integration into internal reports, investment memos, or presentations, facilitating seamless workflow between the platform and your existing processes.

How current is the data on the platform?

aVenture's data is updated in real-time, with live platform metrics tracking changes daily. The platform aggregates information from more than 1,200 data sources, including direct feeds, regulatory databases, and news publications. The AI Analyst ensures that news-based insights are surfaced as they happen, providing users with the most current intelligence available on the private markets.

You may also like:

finban

Plan your liquidity so you can make decisions with confidence: hiring, taxes, projects, investments. Get started quickly, without Excel chaos.

Zignt

Zignt automates secure contract signing with reusable templates and instant delivery.

iGPT

iGPT is a secure API that turns enterprise email into trusted, context-aware answers for AI agents.