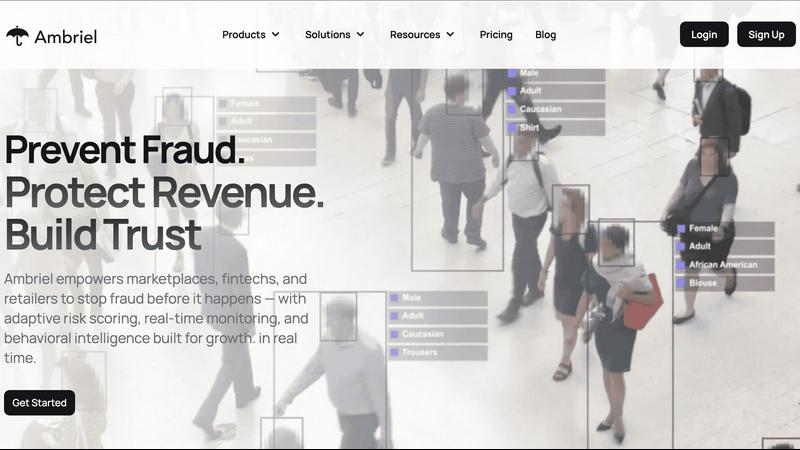

Ambriel

Ambriel is a unified risk engine that detects and stops fraud in real time to protect revenue.

Visit

About Ambriel

Ambriel is an advanced fraud intelligence and risk management platform engineered to secure digital businesses. Its core mission is to enable organizations to operate safely, comply with regulatory standards, and protect their user base, all while ensuring a seamless experience for legitimate customers. The platform is specifically designed for high-risk, high-volume digital sectors including fintech, marketplaces, e-commerce retailers, and iGaming platforms. Ambriel delivers its value by integrating multiple critical security functions into a single, powerful ecosystem. This includes behavioral analytics, device intelligence, sanctions screening, and real-time risk scoring. By analyzing a comprehensive set of signals from transactions, user behaviors, devices, and networks, Ambriel uncovers hidden risk patterns and automates mitigation strategies. This proactive approach allows businesses to detect, score, and prevent fraud before it can impact revenue or damage hard-earned reputation. Ultimately, Ambriel empowers companies to build trust, protect their bottom line, and scale with confidence in a secure environment.

Features of Ambriel

Advanced Fraud Detection

Ambriel's detection capabilities are powered by AI-driven risk scoring that analyzes data from over 200 sources. This system spots suspicious activity, such as payment fraud or synthetic identity creation, in real-time. By identifying these threats as they occur, the platform enables businesses to intervene and protect their revenue before a fraudulent transaction is completed or an abusive account can cause harm.

Sanctions & PEP Screening

To ensure regulatory compliance, Ambriel automates the screening process against more than 100 global sanctions lists, Politically Exposed Persons (PEP) databases, and crime watchlists. This feature eliminates the need for slow, error-prone manual checks, allowing compliance teams to meet legal requirements efficiently without creating bottlenecks for customer onboarding or transaction processing.

Continuous Monitoring

The platform provides 24/7 surveillance of all transactions and user accounts. It continuously tracks for unusual patterns and behavioral anomalies that may indicate fraudulent activity. This ongoing vigilance ensures that potential threats are identified early, and automated alerts allow security teams to investigate and respond before these patterns escalate into significant financial losses or security breaches.

Seamless Onboarding

Ambriel allows businesses to customize their customer and seller onboarding flows with integrated, automated risk checks. This ensures that only verified and trustworthy users are granted access to the platform. By streamlining the process with intelligent background screening, companies can reduce friction for genuine customers while effectively blocking fraudulent sign-ups and synthetic identities.

Use Cases of Ambriel

Onboarding & Registration Fraud

This use case focuses on preventing fraud at the point of account creation. Ambriel detects fake accounts, synthetic identities, and bot-driven signups by analyzing behavioral and device signals during registration. By stopping these threats early, platforms can prevent bad actors from exploiting services, abusing promotions, or launching attacks from within the system.

Payment & Transaction Fraud

Ambriel monitors financial transactions in real-time to identify anomalies and suspicious patterns indicative of fraud, such as stolen card use or unauthorized transfers. This proactive monitoring helps prevent chargebacks, blocks fraudulent payments before they are processed, and secures the financial integrity of every transaction on the platform.

Bonus & Promotion Abuse

Designed to protect marketing investments, this use case identifies and stops users who exploit incentive programs. Ambriel detects multi-accounting, referral scams, and other schemes designed to illegitimately claim bonuses, discounts, or rewards. This ensures promotions remain fair and effective for genuine customers.

Account Takeover Protection

Ambriel safeguards user accounts by identifying unusual login behavior, suspicious device changes, and credential stuffing attempts. By analyzing login patterns and session data, the platform can flag and challenge potentially compromised accounts, helping to keep legitimate customers secure and maintain their trust in the platform.

Frequently Asked Questions

What types of fraud can Ambriel detect?

Ambriel is designed to identify a wide spectrum of fraudulent activities common in digital businesses. This includes multi-accounting, bonus and promotion abuse, referral fraud, synthetic identity creation, payment fraud (like card testing), money laundering, account takeover attempts, and refund or return abuse. Its AI models analyze diverse data points to uncover these complex patterns.

Which industries is Ambriel best suited for?

The platform is specifically built for digital-native, high-transaction-volume industries. Its primary verticals include Financial Services (fintech, digital banks), Retail & E-commerce, Online Marketplaces, iGaming and betting platforms, the Cryptocurrency sector, and Insurance. Its features adapt to the unique risk profiles and regulatory needs of each sector.

How does Ambriel ensure compliance with regulations?

Ambriel incorporates several built-in compliance tools. Its automated Sanctions & PEP screening helps meet Anti-Money Laundering (AML) requirements. The platform is also designed to be KYC-ready and supports GDPR data privacy standards. Furthermore, the company adheres to stringent security certifications like PCI DSS and ISO 27001, providing a compliant foundation for client operations.

Does Ambriel's fraud prevention create friction for real users?

A core principle of Ambriel is to minimize friction for legitimate users. The platform uses intelligent, behind-the-scenes analysis and risk scoring to make decisions. Low-risk transactions and user activities proceed seamlessly, while only high-risk or suspicious events are flagged for additional verification. This balance ensures security without compromising the user experience.

You may also like:

Crowdstake AI

Crowdstake is an AI-powered web and marketing system that helps founders and teams launch beautiful, high-conversion websites.

apptovid

AI powered Promotional Video Maker that can directly turn URL to Video for apps

CIOOffice: the CIO-Software

CIOOffice is a centralized cloud platform for CIOs to manage IT strategy, budgets, projects, and vendor relationships...