Skwad

About Skwad

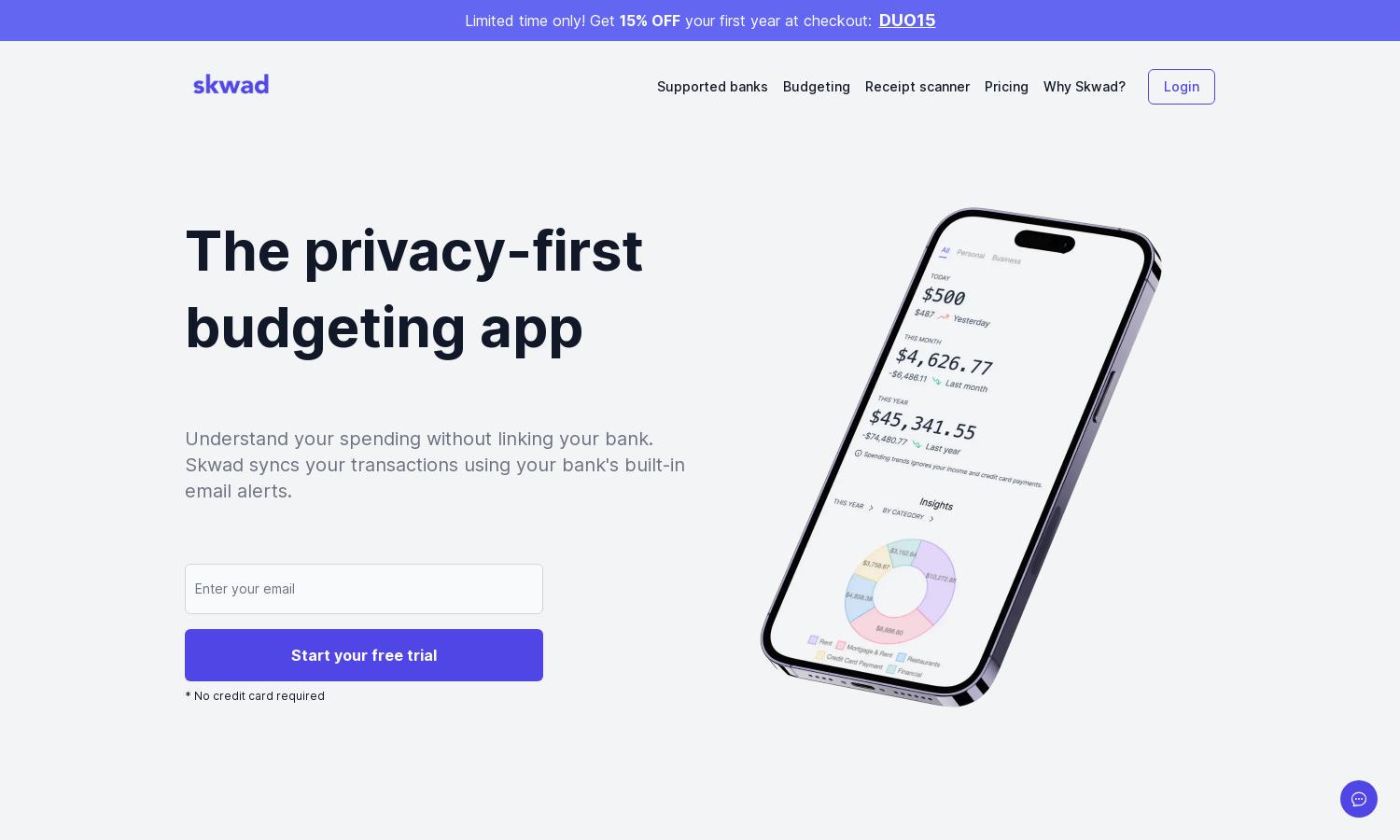

Skwad is a privacy-first budgeting app that provides users with a secure way to track spending and income without linking bank accounts. By utilizing built-in email alerts from banks, Skwad offers a seamless and instant transaction syncing experience, empowering users to maintain financial control with ease.

Skwad offers flexible subscription plans to cater to various user needs, including a free trial and discounts for the first year. Each plan provides access to essential budgeting features, with options to upgrade for advanced functionalities, ensuring users maximize their financial tracking experience.

Skwad features a user-friendly interface designed for seamless navigation, allowing users to easily access budgeting tools and transaction insights. Its layout and functionalities prioritize convenience and simplicity, making it easy for users to manage their finances efficiently without feeling overwhelmed.

How Skwad works

Users interact with Skwad by signing up to receive a dedicated scan email address. They can then forward transaction alerts from their bank directly to this address. The app automatically categorizes these alerts into transactions, eliminating the need for manual entry and ensuring real-time tracking of expenses and income.

Key Features for Skwad

Privacy-first budgeting

Skwad's unique privacy-first budgeting feature allows users to track finances using bank email alerts without sharing sensitive login credentials. This innovative approach ensures that user data remains secure while providing powerful financial insights, making Skwad a trusted solution for budget-conscious individuals.

Instant transaction syncing

With Skwad, users benefit from instant transaction syncing through automated alerts, ensuring real-time visibility into their spending. This unique feature eliminates delays common with traditional budgeting apps that require logins, so users can maintain accurate and timely tracking of their financial activities.

Customizable expense categories

Skwad offers highly customizable expense categories, allowing users to tailor their budgeting experience. This feature enables users to recategorize, split, and hide transactions, ensuring that their budget aligns with their specific financial goals and spending habits, enhancing user engagement and satisfaction.