Jinnee

About Jinnee

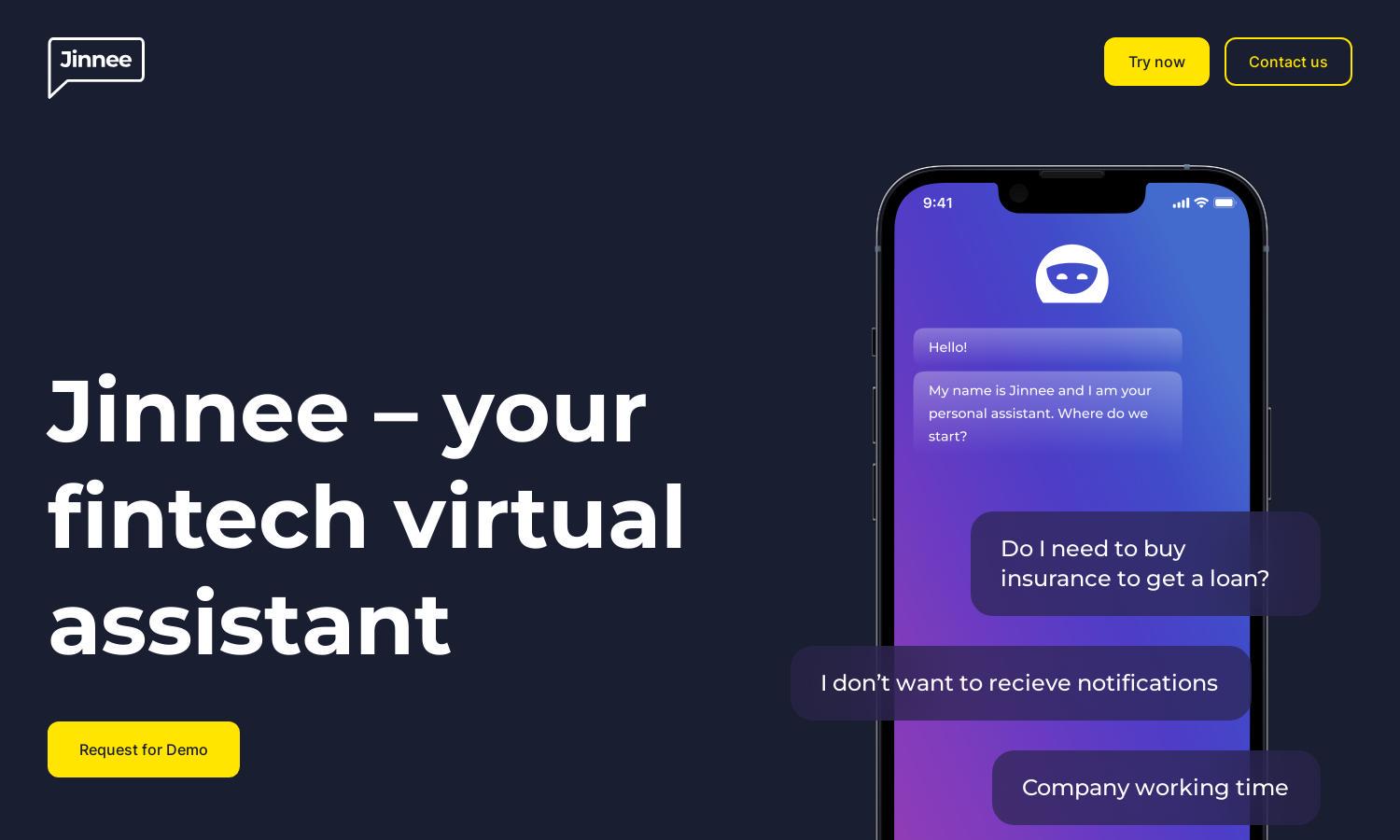

Jinnee is an innovative fintech virtual assistant designed to enhance customer service for banks and financial institutions. With a focus on personalized banking advice and 24/7 availability, Jinnee addresses client inquiries promptly, improving user satisfaction through insightful analytics and automated learning to better accommodate customer needs.

Jinnee offers flexible pricing plans tailored to various business sizes, starting from basic to advanced tiers. Each plan provides essential features like AI-driven customer support and analytics, with higher tiers unlocking more personalized services and insights. Upgrading enhances operational efficiency at every level, making Jinnee invaluable.

Jinnee features an intuitive user interface that streamlines customer interactions and accessibility. The layout is designed for seamless navigation, ensuring users can easily access support options and insights. Its user-friendly design reflects Jinnee's commitment to enhancing the overall experience, making it easy to leverage the platform's capabilities.

How Jinnee works

Users interact with Jinnee by onboarding through a simple setup process. Once registered, they can navigate the platform to access 24/7 customer support, create custom chatbots, and analyze interactions using insightful metrics. The system's automated learning adapts to client needs, ensuring efficient problem resolution while providing personalized banking advice, making Jinnee a valuable asset for users.

Key Features for Jinnee

24/7 Customer Support

Jinnee's standout feature is its 24/7 customer support, making it an invaluable tool for fintech companies. This ensures clients receive timely responses whenever they need assistance, reducing frustration and enhancing user experience. With Jinnee, businesses can handle a high volume of queries efficiently, optimizing customer satisfaction.

Personalized Banking Services

Jinnee excels in delivering personalized banking services, acting as a virtual financial advisor for clients. By understanding individual user needs, it provides tailored financial advice and product recommendations quickly. This unique feature enhances user interactions, allowing customers to access expert guidance without delays, thus improving financial decision-making.

Automated Learning

Jinnee's automated learning capability continually adapts to clients' intents by analyzing inquiries and behaviors. This distinctive feature allows the platform to improve over time, ensuring increasingly relevant responses to user questions. By leveraging evolved insights, Jinnee enhances customer interaction quality, making it essential for modern fintech environments.

You may also like: