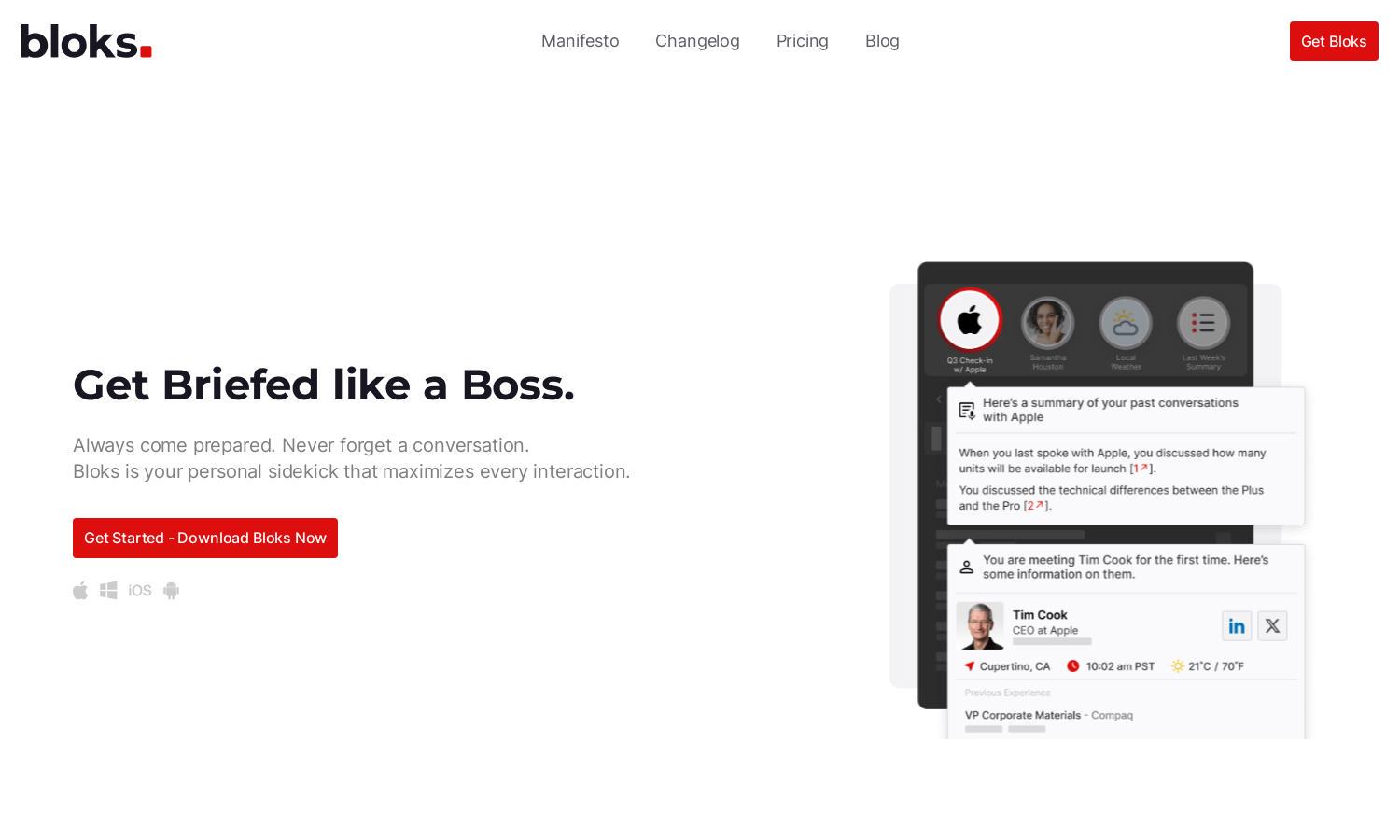

Bloks

About Bloks

Bloks is an innovative platform tailored for venture teams that automates tedious tasks, allowing users to focus on investor workflows. With features like automatic note-taking and data extraction, Bloks streamlines the venture capital process, enhancing efficiency and productivity for firms seeking to build successful investments.

Bloks offers diverse pricing plans to suit various venture teams, emphasizing affordability and value. Each tier unlocks advanced automation and data integration features, with potential discounts for early adopters. Discover the benefits of upgrading to enhance your venture capital operations with Bloks.

Bloks delivers a user-friendly interface designed for seamless navigation across its features. The intuitive layout enhances the user experience, allowing venture teams to access automation tools easily. With Bloks, users can efficiently manage their workflows and enjoy a streamlined, productive environment.

How Bloks works

Users begin their journey with Bloks by signing up for an account and completing a seamless onboarding process. They can then easily navigate the platform's features, utilizing automatic note-taking, data extraction from various sources, and custom CRM integrations to optimize their venture workflows and enhance productivity.

Key Features for Bloks

Automatic Note-Taking

Bloks offers automatic note-taking that captures essential meeting points based on personalized templates. This feature minimizes the burden of manual documentation, enabling venture teams to focus on discussions while ensuring that critical insights are recorded effectively for future reference.

Data Extraction and Syncing

Bloks features an advanced data extraction tool that syncs information from various sources like emails, documents, and pitch decks directly to the CRM. This integration ensures that venture teams have real-time access to crucial data, enhancing decision-making and visibility in their workflows.

VC-Specific Briefs and Reports

Bloks generates VC-specific briefs and customizable reports, such as Investment Memos and Quarterly LP updates. This unique feature allows firms to streamline their reporting processes, saving time and effort in creating detailed documentation essential for investor relations and decision-making.