Addy AI

About Addy AI

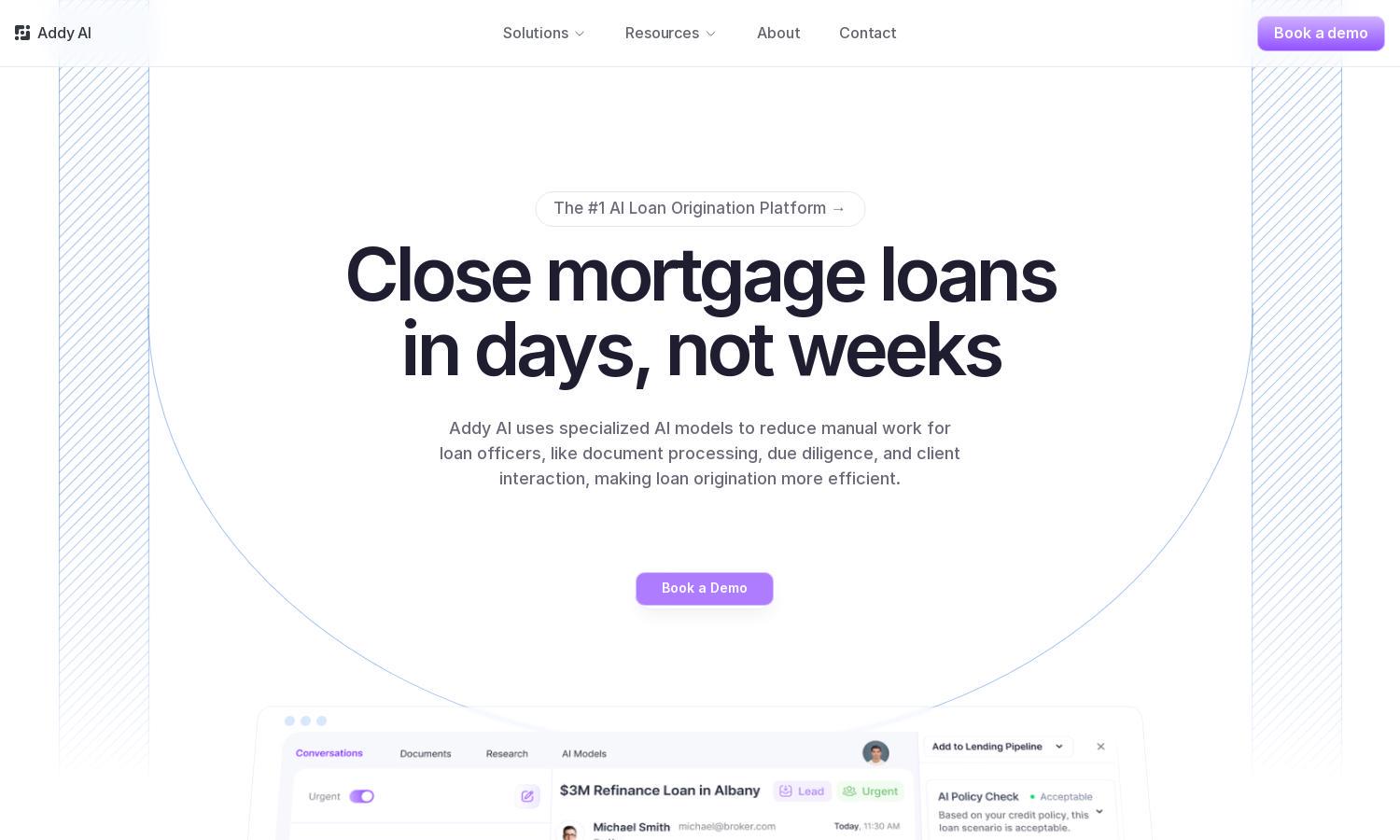

Addy AI revolutionizes the loan origination process for mortgage lenders. By enabling the training of custom AI models, Addy AI significantly improves efficiency and reduces manual work for loan officers. Users benefit from 24/7 automation of client interactions, document processing, and loan assessments, solving common industry bottlenecks.

Addy AI offers various pricing tiers, ensuring affordability for all mortgage lenders. Each subscription provides different features, including advanced document processing and AI model training. Users can benefit from special discounts for annual commitments, enhancing their loan origination efficiency with premium services offered at competitive rates.

The user interface of Addy AI is designed for seamless navigation and ease of use. Its intuitive layout allows users to quickly access core features such as document processing and client management. Unique functionalities, like natural language chat with mortgage documents, create an engaging and productive experience for users.

How Addy AI works

Users start by signing up on Addy AI, where they can easily navigate to set up their custom AI models tailored to their loan origination needs. The platform guides users through document uploads, client data integration, and model training. With its intuitive interface, users can automate client follow-ups, extract loan data, or assess credit eligibility efficiently, streamlining the overall mortgage lending process.

Key Features for Addy AI

Automated Document Processing

Addy AI's automated document processing feature revolutionizes how mortgage lenders handle paperwork. By utilizing advanced AI technology, this feature quickly analyzes and extracts relevant information from various documents, significantly reducing manual data entry time and boosting workflow efficiency for loan officers.

Client Interaction Automation

Addy AI enhances client interaction through its specialized AI models, automating follow-up communications around the clock. This feature ensures timely responses to borrower inquiries, improving client satisfaction while freeing up loan officers to focus on more complex tasks, ultimately elevating service quality.

Instant Loan Assessment

The instant loan assessment feature of Addy AI provides rapid evaluations of borrower eligibility based on predefined credit policies. This tool not only accelerates the approval process but also offers actionable suggestions to help ineligible borrowers improve their chances, ultimately expediting loan origination.